We at The Ocean Foundation envisioned an unprecedented ocean-centric investment fund. Thus, over 5 years we reviewed over 3,000 companies looking for products and services that are “actively good for the ocean.”

We at The Ocean Foundation envisioned an unprecedented ocean-centric investment fund. Thus, over 5 years we reviewed over 3,000 companies looking for products and services that are “actively good for the ocean.”

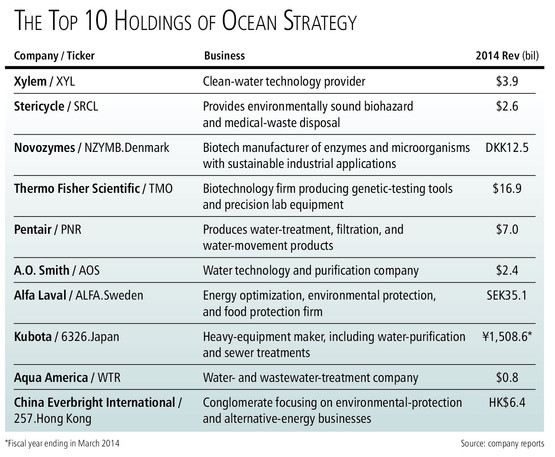

In 2012 we co-launched the Rockefeller Ocean Strategy, as an international, all cap, private placement in active, long-only publicly traded securities. As such, it is a “Triple-Screened Fund.” TOF screens each company with ocean health in mind, and provides Rockefeller & Co. specialized insight and research on coastal and ocean trends, risks and opportunities. Rock&Co then screens each company for investment quality and standard CSR criteria.

We hold positions in about 52 companies, and have over $19m under management. And, we are offering an alternative for those divesting of fossil fuel company stock. Later this year, we will have a 36 month track record and will be able to seek institutional investors. Thus, we are well on our way to confirming our thesis that investing in companies that have a product or service that is actively good for the ocean will make profits, and help investors earn income. And, we are helping make the ocean healthier in the process!

Read the Barron’s story here.